36+ Should i borrow the maximum mortgage

According to Statista the total mortgage debt of Americans from 1950 to 2019 increased from 005 trillion to 1061 trillion. But high home prices may make the dream seem out of reach.

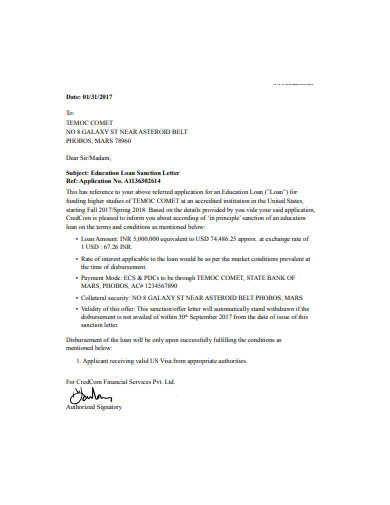

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

28 percent and 36 percent.

. Who should use this publication. Just because a bank says it will lend you 300000 doesnt mean that you should actually borrow that much. Consistent payments Youll have the same principal and interest payment for the life of the loanFixed-Rate Home Equity loans are available in all 50 states.

You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price. However we may be able to achieve a bridge loan through the use of a home equity line of credit on the house you will be selling. The maximum amount you can elect to deduct for most section 179 property including cars trucks and vans you placed in service in tax years beginning in 2021 is 1050000.

This will depend on the amount of equity you have and your ability to qualify to carry the debt for your existing mortgage if any the home equity line of credit and the mortgage on your new home. Multiply your annual salary by 036 percent then divide the total by 12. It was originally established after World War II to help returning war veterans find housing.

Subtract your other debts including your car payment your student loan payment and other debt payments from this amount to determine the maximum amount you can spend on your monthly mortgage payment. 49 171 68 400 80. The 2836 rule is a heuristic used to calculate the amount of housing debt one.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Fixed-Rate Home Equity Loans. The original Social Security Act was enacted in 1935 and the current version of the Act as amended encompasses several social welfare and social insurance programs.

Want to borrow over part years - for example 15 years and 6 months. CLTV FOR RATE SHOWN 60 of your homes value. That is one of the reasons why lenders must first assess the risk before placing their money on the line.

Every borrowers situation is different but there are at least two schools of thought on how much of your gross income should be allocated to your mortgage. How much can I afford to borrow. NW IR-6526 Washington DC 20224.

DCU service for the life of the loan Well service your loan as long as you have itNo need to worry about making payments to a different lender. In the United States Social Security is the commonly used term for the federal Old-Age Survivors and Disability Insurance OASDI program and is administered by the Social Security Administration. Many first-time homebuyers make this mistake and end up house poor with little.

Debt is an obligation that requires one party the debtor to pay money or other agreed-upon value to another party the creditorDebt is a deferred payment or series of payments which differentiates it from an immediate purchase. MAXIMUM TERM FOR RATE SHOWN 5 Years. For example you might pay interest of 9 on a 3000 loan but only 3 on a loan of 7000.

How much will my loan payments be. Your insurance provider covers 125 of your mortgage. This is the maximum amount you can pay toward debts each month.

The loan is secured on the borrowers property through a process. This mortgage calculator gives you a quick overview of your real estate financing in Germany. Interest rates on personal loans vary across the market but as a rough rule of thumb the more you borrow the lower the rate.

Mortgage programs that fit your needs with DCU service for the life of your loan. Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage. To make monthly mortgage payments more affordable many lenders offer home loans that allow you to 1 pay only the interest on the loan during the first few years of the loan term or 2 make only a specified minimum payment that could be less than the.

An FHA mortgage has special rules set by the government. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. The debt may be owed by sovereign state or country local government company or an individualCommercial debt is generally subject to.

Canada Mortgage and Housing Corporation CMHC is a Crown Corporation of the Government of Canada. Owning a home is part of the American dream. Mortgage Rates.

German Mortgage Repayment Calculator. What is my loan rate. Mortgage Payment Protection Insurance MPPI MPPI provides longer mortgage protection for 12 months up to 2 years depending on your policy.

You may be able to borrow up to 100 of the funds needed to buy a vehicle and take up to 8 years to repay the amount. This means there is less wiggle room when qualifying for these loans versus conventional mortgage products. Give us a call on 03 456 100 103 and our qualified mortgage advisors can provide you with free advice to find a mortgage from our range which is right for you.

We welcome your comments about this publication and your suggestions for future editions. It can therefore make sense to borrow a larger amount say 7000 instead of 6500. As a requirement you must make a 5.

The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income. Ultimately your maximum mortgage. The organizations primary goals are to provide mortgage liquidity assist in affordable housing.

936 Home Mortgage Interest Deduction for more information. Find out how much you can afford to borrow with NerdWallets mortgage calculator. It has since expanded its mandate to improve Canadians access to housing.

Minimum FICO score of 670 and minimum income of 24000 for each loan. Letters of explanation are a lenders way of saying that they are willing to let you borrow money. Should I consolidate my loans.

49 30 28 39 31 36 Mobile. The maximum mortgage calculator will allow you to input your monthly obligations your monthly income to calculate the maximum monthly mortgage payment. 1 Learn more about the CIBC Personal Car Loan.

How much you can afford to borrow depends on a number of factors not just what a bank is willing to lend you.

1

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

How To Get A Mortgage From Pre Approval To Closing Home Improvement Loans Home Mortgage Refinance Mortgage

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

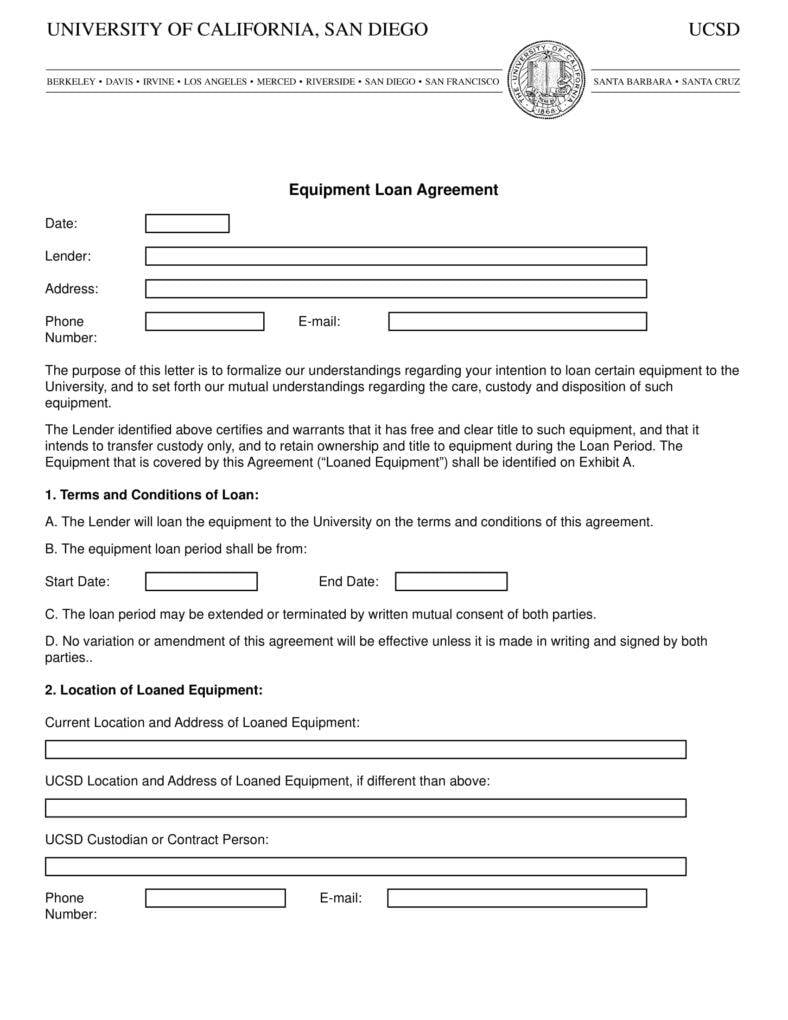

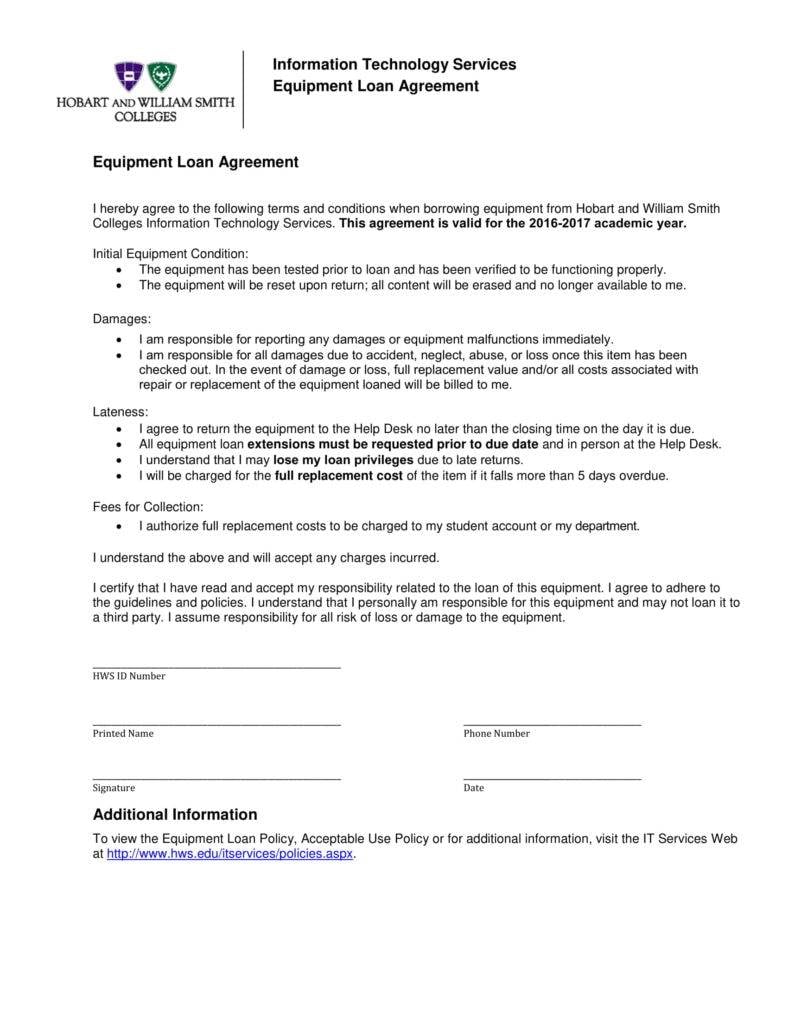

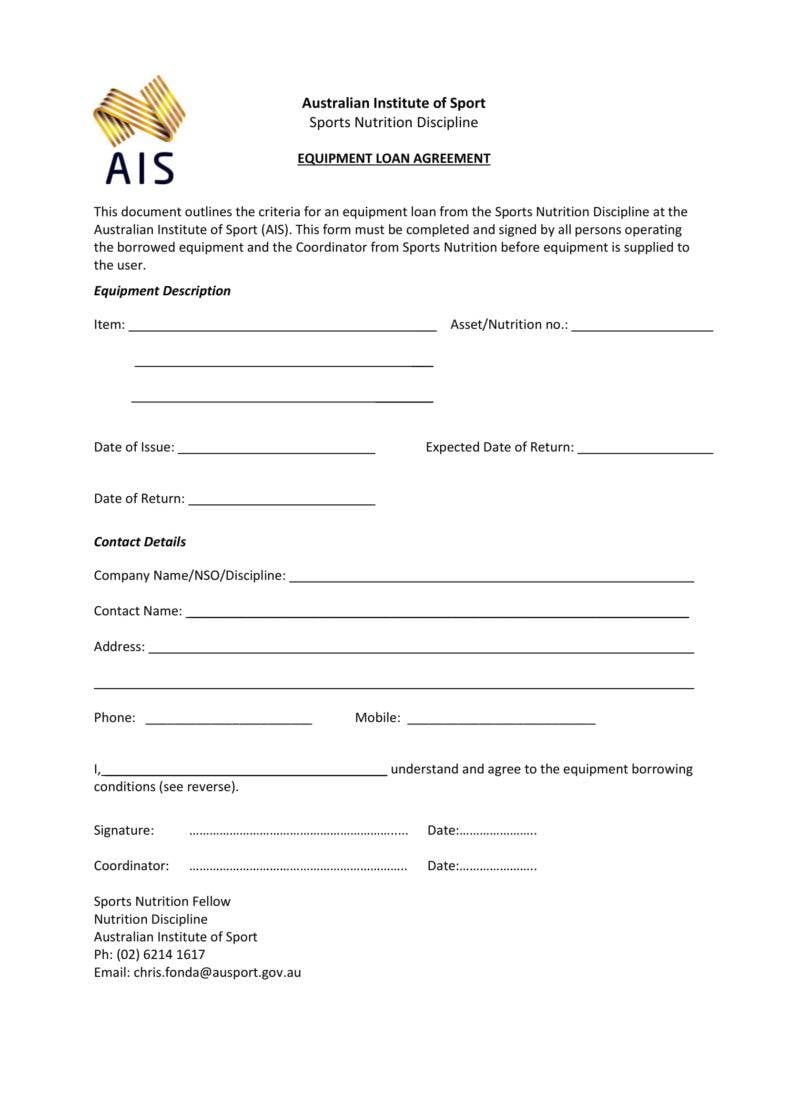

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

1

1

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

Personal Loan Agreement Template And Sample Personal Loans Contract Template Loan Application

Investing Calculator Borrow Money

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

36 Sample Letter Of Explanation Templates In Pdf Ms Word

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

1

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

Fha Closing Cost Assistance For 2022 Fha Lenders In 2022 Closing Costs Fha Real Estate Tips